Netflix’s Transformation Strategy: Strong Financial Results and New Revenue Streams

Netflix has demonstrated exceptional financial performance in recent months while implementing a significant transformation strategy focused on new subscription models, advertising, live content, and expanding into the gaming sector.

Q1 2025 Financial Results

Netflix reported revenues of $10.54 billion for the first quarter of 2025, representing a 13% growth compared to the same period in 2024. Net profit reached $2.9 billion, with earnings per share (EPS) of $6.61, significantly exceeding market forecasts of $5.69. The company expects an operating margin between 29-31.7% for the full year, with free cash flow showing strong growth.

Following the announcement of these results, Netflix’s stock rose 2.44% in after-market trading, reaching approximately $996.80.

New Subscription Model and Advertising Strategy

Since January 2025, Netflix has revised its subscription pricing structure, increasing rates for standard and premium plans as well as for its ad-supported plan (from $6.99 to $7.99 monthly). The company has decided to stop reporting subscriber numbers on a quarterly basis, focusing instead on financial and engagement metrics, as account sharing and new subscription models make traditional subscriber data less representative. The ad-supported plan (AVOD) continues to grow rapidly, with over 40 million monthly active users globally, representing more than 40% of new subscriptions in markets where it’s available. Netflix expects to double its advertising revenue in 2025 thanks to the launch of its proprietary advertising technology platform, which will enable programmatic buying, advanced targeting, and improved measurement. This advertising platform has already launched in the US and will be extended to 10 additional markets by the end of the year.

Expansion into Live Content and Gaming

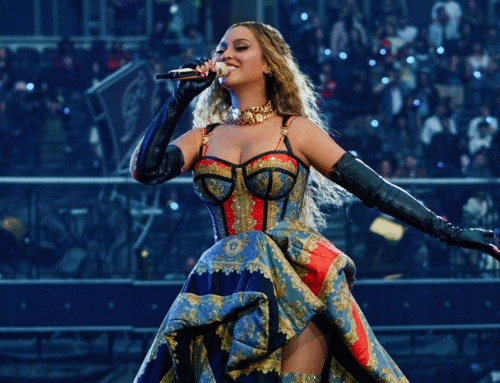

Netflix is strengthening its live content offerings following the success of events like the Tyson vs. Jake Paul boxing match, acquiring rights to sporting events such as WWE and the FIFA Women’s World Cup to attract real-time audiences and advertisers.

In the gaming sector, Netflix has invested more than $2 billion since 2021, acquiring development studios and expanding its catalog to approximately 140 titles available to subscribers without ads or microtransactions. The goal is to integrate video games directly into the Netflix app, especially on smart TVs, to increase user engagement and retention.

Market Position and Outlook

Netflix has surpassed 300 million subscribers globally (cumulative data, no longer reported quarterly). The company maintains its leadership position in streaming with a strategy aimed at diversifying revenue streams and consumption models, balancing higher prices with advertising offerings and new digital services. Analysts forecast total revenue between $43.5 and $44.5 billion for 2025, with operating margins around 29%.

In summary, Netflix is strengthening its leadership position in the streaming market with solid revenue growth, aggressive expansion of advertising, and strategic investment in gaming and live content, adapting to changes in consumer habits and competitive dynamics in the industry.

Source: Netflix

Share:

Netflix has demonstrated exceptional financial performance in recent months while implementing a significant transformation strategy focused on new subscription models, advertising, live content, and expanding into the gaming sector.

Q1 2025 Financial Results

Netflix reported revenues of $10.54 billion for the first quarter of 2025, representing a 13% growth compared to the same period in 2024. Net profit reached $2.9 billion, with earnings per share (EPS) of $6.61, significantly exceeding market forecasts of $5.69. The company expects an operating margin between 29-31.7% for the full year, with free cash flow showing strong growth.

Following the announcement of these results, Netflix’s stock rose 2.44% in after-market trading, reaching approximately $996.80.

New Subscription Model and Advertising Strategy

Since January 2025, Netflix has revised its subscription pricing structure, increasing rates for standard and premium plans as well as for its ad-supported plan (from $6.99 to $7.99 monthly). The company has decided to stop reporting subscriber numbers on a quarterly basis, focusing instead on financial and engagement metrics, as account sharing and new subscription models make traditional subscriber data less representative. The ad-supported plan (AVOD) continues to grow rapidly, with over 40 million monthly active users globally, representing more than 40% of new subscriptions in markets where it’s available. Netflix expects to double its advertising revenue in 2025 thanks to the launch of its proprietary advertising technology platform, which will enable programmatic buying, advanced targeting, and improved measurement. This advertising platform has already launched in the US and will be extended to 10 additional markets by the end of the year.

Expansion into Live Content and Gaming

Netflix is strengthening its live content offerings following the success of events like the Tyson vs. Jake Paul boxing match, acquiring rights to sporting events such as WWE and the FIFA Women’s World Cup to attract real-time audiences and advertisers.

In the gaming sector, Netflix has invested more than $2 billion since 2021, acquiring development studios and expanding its catalog to approximately 140 titles available to subscribers without ads or microtransactions. The goal is to integrate video games directly into the Netflix app, especially on smart TVs, to increase user engagement and retention.

Market Position and Outlook

Netflix has surpassed 300 million subscribers globally (cumulative data, no longer reported quarterly). The company maintains its leadership position in streaming with a strategy aimed at diversifying revenue streams and consumption models, balancing higher prices with advertising offerings and new digital services. Analysts forecast total revenue between $43.5 and $44.5 billion for 2025, with operating margins around 29%.

In summary, Netflix is strengthening its leadership position in the streaming market with solid revenue growth, aggressive expansion of advertising, and strategic investment in gaming and live content, adapting to changes in consumer habits and competitive dynamics in the industry.

Source: Netflix