The Sixth Report on Italian Audiovisual Production is out!

At the tenth edition of the MIA-International Audiovisual Market in Rome, the sixth APA (Association of Italian Audiovisual Producers) Report reveals that the Italian audiovisual industry is growing and entering a new phase. The report highlights that the industry’s value in 2023 has nearly doubled compared to 2017, exceeding 2 billion euros and achieving a steady annual growth rate of 11.6%. Television remains the primary audiovisual medium, generating revenues of €8.2 billion in 2023 (71% of the total market).

At a Glimpse:

Production volumes for the three primary target channels are growing compared to 2022:

- Productions aimed at movie theatres increased by 21%.

- Productions for VoD platforms rose by 16%.

- Productions for TV grew by 8%.

Revenue is also on the rise:

- Total revenue exceeded 12 billion euros in 2023.

- Income increased by 20% compared to the previous year.

Online platforms (AVoD and Pay VoD) accounted for:

- 2.8 billion euros (24% of the total market).

Cinema represents the remaining share, showing a solid recovery since the pandemic years, supported by promotional summer campaigns.

Employment within the sector is also increasing:

- Currently, there are 120,000 employees.

- Growth of 3.5% over the past year.

There has been a significant increase in productions aimed at young audiences:

- Notable 70% rise in hours of Fiction Kids & Early Teens content in 2023.

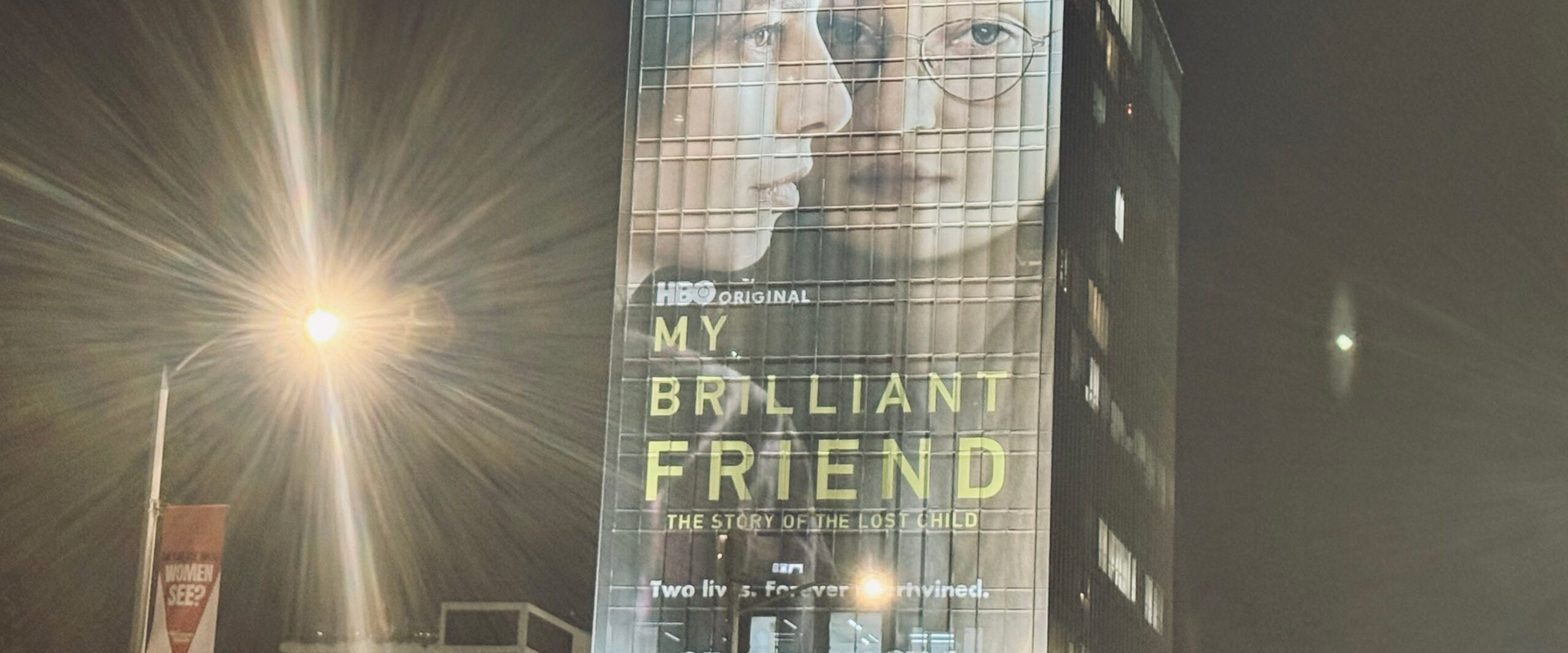

Series remain the dominant format, with new genres like period pieces, biopics, and romance gaining interest from producers and audiences.

Netflix and Paramount+ are the OTT platforms showing the most significant growth:

- Notable increases in the number of titles and hours of content produced.

That said, producers are set to face a considerable challenge over the coming year. “As part of a general consolidation of the market, favoured by the growing demand for content and by tax credit”, explained APA (and Cinecittà) president Chiara Sbarigia as she presented the data, “the sector is now entering into a new phase geared towards a greater selection of projects on the basis of the quality of the product and its potential for circulation beyond national borders”.

Initiated in 2017 by the APA, this year’s report includes a comparative analysis with four major European production countries: France, Spain, Germany, and the UK. In terms of production incentives, the analysis highlights that while Italy provides a variety of public subsidies and aid, other countries have notable funding structures. Spain has strong national support, Germany offers substantial regional incentives, and the UK had higher production investment levels in 2022 compared to the other countries analyzed.

In 2022, Italy’s tax credit system supported around 40% of the projects funded by the UK tax credit (572 vs. 1,405) and about half of those supported by France. The total Italian spending on tax credits for films and audiovisual projects in 2022 was 768 million euros, compared to the UK’s 1.631 billion euros. This data offers insight into the different funding landscapes across Europe, emphasizing Italy’s position within this context.

Source: APA Website

Share:

At the tenth edition of the MIA-International Audiovisual Market in Rome, the sixth APA (Association of Italian Audiovisual Producers) Report reveals that the Italian audiovisual industry is growing and entering a new phase. The report highlights that the industry’s value in 2023 has nearly doubled compared to 2017, exceeding 2 billion euros and achieving a steady annual growth rate of 11.6%. Television remains the primary audiovisual medium, generating revenues of €8.2 billion in 2023 (71% of the total market).

At a Glimpse:

Production volumes for the three primary target channels are growing compared to 2022:

- Productions aimed at movie theatres increased by 21%.

- Productions for VoD platforms rose by 16%.

- Productions for TV grew by 8%.

Revenue is also on the rise:

- Total revenue exceeded 12 billion euros in 2023.

- Income increased by 20% compared to the previous year.

Online platforms (AVoD and Pay VoD) accounted for:

- 2.8 billion euros (24% of the total market).

Cinema represents the remaining share, showing a solid recovery since the pandemic years, supported by promotional summer campaigns.

Employment within the sector is also increasing:

- Currently, there are 120,000 employees.

- Growth of 3.5% over the past year.

There has been a significant increase in productions aimed at young audiences:

- Notable 70% rise in hours of Fiction Kids & Early Teens content in 2023.

Series remain the dominant format, with new genres like period pieces, biopics, and romance gaining interest from producers and audiences.

Netflix and Paramount+ are the OTT platforms showing the most significant growth:

- Notable increases in the number of titles and hours of content produced.

That said, producers are set to face a considerable challenge over the coming year. “As part of a general consolidation of the market, favoured by the growing demand for content and by tax credit”, explained APA (and Cinecittà) president Chiara Sbarigia as she presented the data, “the sector is now entering into a new phase geared towards a greater selection of projects on the basis of the quality of the product and its potential for circulation beyond national borders”.

Initiated in 2017 by the APA, this year’s report includes a comparative analysis with four major European production countries: France, Spain, Germany, and the UK. In terms of production incentives, the analysis highlights that while Italy provides a variety of public subsidies and aid, other countries have notable funding structures. Spain has strong national support, Germany offers substantial regional incentives, and the UK had higher production investment levels in 2022 compared to the other countries analyzed.

In 2022, Italy’s tax credit system supported around 40% of the projects funded by the UK tax credit (572 vs. 1,405) and about half of those supported by France. The total Italian spending on tax credits for films and audiovisual projects in 2022 was 768 million euros, compared to the UK’s 1.631 billion euros. This data offers insight into the different funding landscapes across Europe, emphasizing Italy’s position within this context.

Source: APA Website