Coping with Financial Fallout: Industry Struggles Post-Recent Strikes

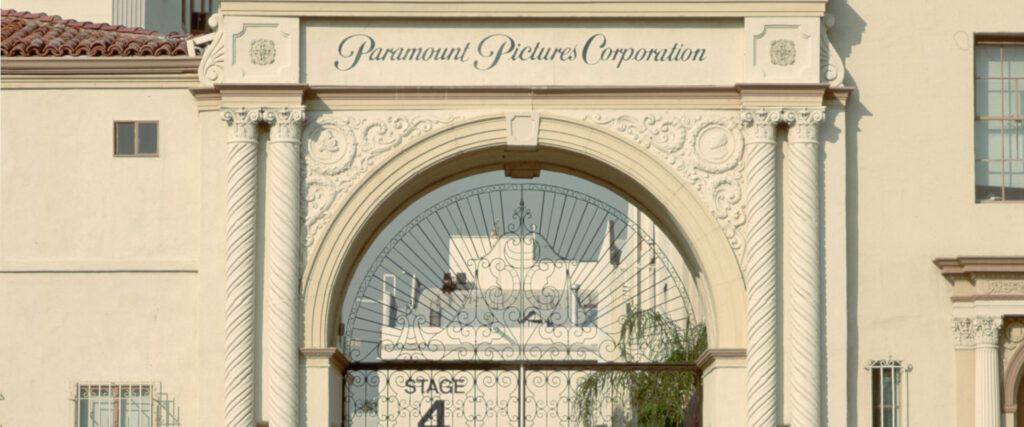

In the aftermath of last year’s strikes by writers and actors in the film and TV industry, professionals are facing prolonged financial strain, awaiting a production rebound that has been slower than anticipated. While the industry figures out how to emerge from the crisis, hundreds of thousands of people are struggling to manage their bills, rent, mortgages, health insurance, and school costs in a city like Los Angeles, which seems to become more demanding and expensive every day. Economic distress has extended broadly, impacting even those accustomed to higher earnings, who have exhausted savings and dipped into retirement funds.

Financial experts consulted by the Los Angeles Times emphasize the critical role of meticulous budgeting during lean periods and recommend strategic financial maneuvers to endure until normal production levels return. Everyone advises starting small, beginning to change their lifestyle by saving on daily expenses. “Scrutinizing monthly spending is crucial,” advises Justin Pritchard, a certified financial planner. Neela Hummel underscores housing and transportation as pivotal cost areas, suggesting shared accommodations or downgraded vehicles to reduce expenses. Joanne Danganan highlights dining expenses as a major outlay, proposing meal kit services as a compromise between convenience and thrift.

On a broader scale, experts advocate seeking guidance from resources like the Entertainment Community Fund, which offers comprehensive financial wellness programs and career workshops. The Fund can assist with transitions and provide financial advice, including negotiating debt and exploring debt management strategies such as consolidation loans or credit card balance transfers. Furthermore, options for negotiating medical debt and exploring charitable care programs are highlighted to alleviate financial burdens. Consider all available financial resources and strategies to navigate the ongoing economic uncertainties, but be cautious about accruing further debt without a clear repayment strategy.

In tough times like these, exploring diverse job opportunities and leveraging professional networks beyond immediate circles may be necessary.

Share:

In the aftermath of last year’s strikes by writers and actors in the film and TV industry, professionals are facing prolonged financial strain, awaiting a production rebound that has been slower than anticipated. While the industry figures out how to emerge from the crisis, hundreds of thousands of people are struggling to manage their bills, rent, mortgages, health insurance, and school costs in a city like Los Angeles, which seems to become more demanding and expensive every day. Economic distress has extended broadly, impacting even those accustomed to higher earnings, who have exhausted savings and dipped into retirement funds.

Financial experts consulted by the Los Angeles Times emphasize the critical role of meticulous budgeting during lean periods and recommend strategic financial maneuvers to endure until normal production levels return. Everyone advises starting small, beginning to change their lifestyle by saving on daily expenses. “Scrutinizing monthly spending is crucial,” advises Justin Pritchard, a certified financial planner. Neela Hummel underscores housing and transportation as pivotal cost areas, suggesting shared accommodations or downgraded vehicles to reduce expenses. Joanne Danganan highlights dining expenses as a major outlay, proposing meal kit services as a compromise between convenience and thrift.

On a broader scale, experts advocate seeking guidance from resources like the Entertainment Community Fund, which offers comprehensive financial wellness programs and career workshops. The Fund can assist with transitions and provide financial advice, including negotiating debt and exploring debt management strategies such as consolidation loans or credit card balance transfers. Furthermore, options for negotiating medical debt and exploring charitable care programs are highlighted to alleviate financial burdens. Consider all available financial resources and strategies to navigate the ongoing economic uncertainties, but be cautious about accruing further debt without a clear repayment strategy.

In tough times like these, exploring diverse job opportunities and leveraging professional networks beyond immediate circles may be necessary.