Shari Redstone Halts Skydance’s Attempt to Acquire Paramount Stake

In a significant development within the media landscape, Shari Redstone has decided to terminate the negotiations between her company, National Amusements Inc. (NAI), and Skydance Media over the sale of her controlling stake in Paramount Global. This decision was first reported by The Wall Street Journal and marks a pivotal moment in the ongoing restructuring efforts at Paramount.

NAI expressed its appreciation for Skydance’s efforts, stating, “NAI is grateful to Skydance for their months of work in pursuing this potential transaction and looks forward to the ongoing, successful production collaboration between Paramount and Skydance.” Following the announcement, Paramount Global’s shares took a significant hit, plunging nearly 8%.

The withdrawal of Skydance from the acquisition talks comes as Paramount’s three co-CEOs roll out a new strategic plan aimed at reducing costs and securing a partner for the company’s struggling streaming service, Paramount+. This plan is crucial for Paramount as it seeks to stabilize its financial footing in an increasingly competitive media environment. NAI has publicly supported this strategic direction. Originally, the Skydance deal was set to be a two-part transaction. The first phase involved Skydance acquiring National Amusements for an estimated $1.7 billion in cash. Skydance, known for producing blockbusters such as Top Gun: Maverick and Mission: Impossible – Dead Reckoning Part One, seemed poised to enhance its industry standing significantly through this acquisition.

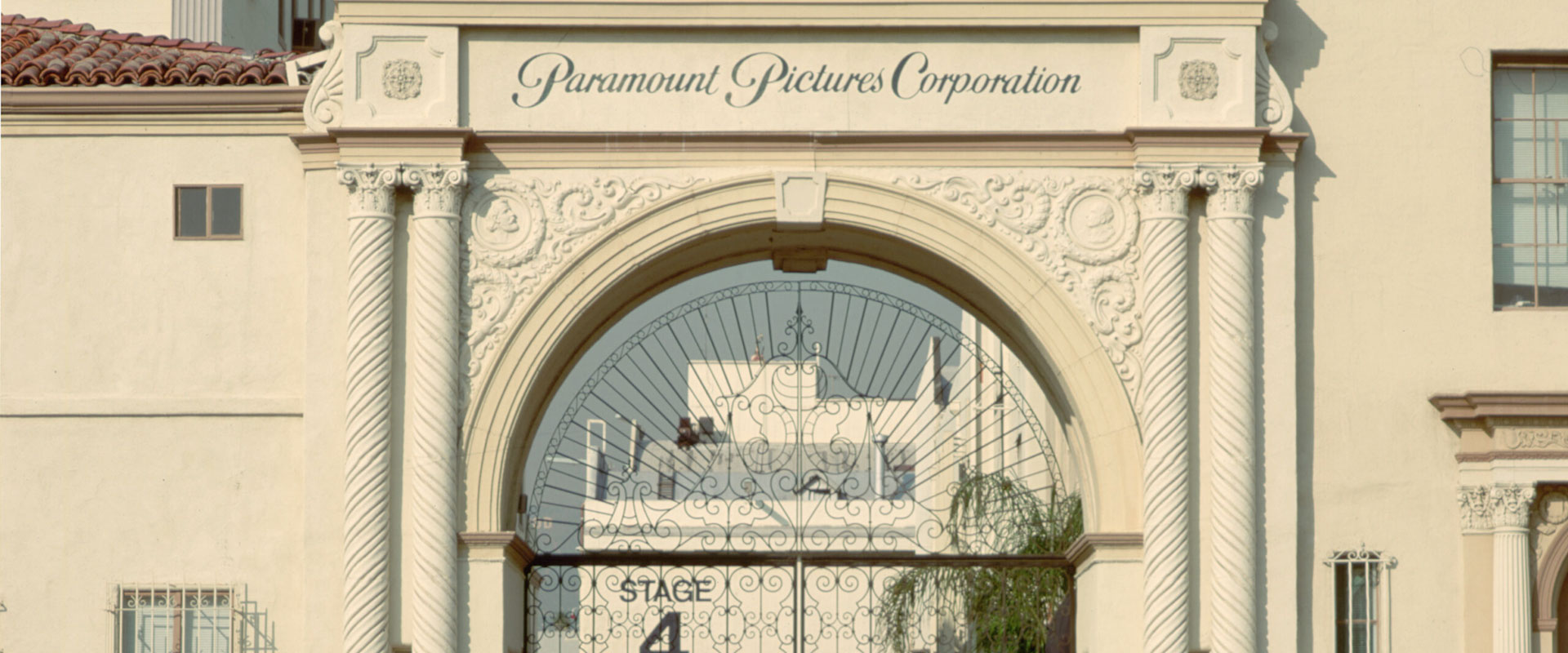

The second phase of the proposed deal was more complex, involving a merger between Skydance and Paramount Global, a major media conglomerate that includes Paramount Pictures, CBS, MTV, and Nickelodeon. This merger was set to be executed as a stock transaction and required careful negotiation and approval from a committee of Paramount’s directors. According to The Wall Street Journal, while the economic terms of the merger had been agreed upon, other critical aspects were still under discussion. Paramount’s board had been advocating for the merger to be subject to a vote by all shareholders, a point of contention for Skydance. The Journal reported that Skydance found the idea of a shareholder vote “a nonstarter.” The committee was expected to vote on the merger on Tuesday, but the outcome of that vote remains uncertain.

Following the collapse of the Skydance deal, it appears Redstone will now explore selling National Amusements independently, without the added complexity of merging Paramount with another entity. NAI has already attracted interest from other potential buyers, including a group led by Hollywood producer Steven Paul and media executive Edgar Bronfman Jr., who has backing from private equity giant Bain Capital. This continued interest underscores the significant value and strategic importance of NAI’s assets.

As of now, both Paramount and Skydance have declined to provide further comments on the matter. The future direction of Paramount and the potential sale of NAI remain closely watched by industry analysts and investors.

SOURCE Wall Street Journal: https://www.wsj.com/business/media/shari-redstones-nai-

decides-to-stop-discussions-with-skydance-1b81985b

NY Post: https://nypost.com/2024/06/11/media/shari-redstone-kills-skydance-bid-for-

paramount-global/

Share:

In a significant development within the media landscape, Shari Redstone has decided to terminate the negotiations between her company, National Amusements Inc. (NAI), and Skydance Media over the sale of her controlling stake in Paramount Global. This decision was first reported by The Wall Street Journal and marks a pivotal moment in the ongoing restructuring efforts at Paramount.

NAI expressed its appreciation for Skydance’s efforts, stating, “NAI is grateful to Skydance for their months of work in pursuing this potential transaction and looks forward to the ongoing, successful production collaboration between Paramount and Skydance.” Following the announcement, Paramount Global’s shares took a significant hit, plunging nearly 8%.

The withdrawal of Skydance from the acquisition talks comes as Paramount’s three co-CEOs roll out a new strategic plan aimed at reducing costs and securing a partner for the company’s struggling streaming service, Paramount+. This plan is crucial for Paramount as it seeks to stabilize its financial footing in an increasingly competitive media environment. NAI has publicly supported this strategic direction. Originally, the Skydance deal was set to be a two-part transaction. The first phase involved Skydance acquiring National Amusements for an estimated $1.7 billion in cash. Skydance, known for producing blockbusters such as Top Gun: Maverick and Mission: Impossible – Dead Reckoning Part One, seemed poised to enhance its industry standing significantly through this acquisition.

The second phase of the proposed deal was more complex, involving a merger between Skydance and Paramount Global, a major media conglomerate that includes Paramount Pictures, CBS, MTV, and Nickelodeon. This merger was set to be executed as a stock transaction and required careful negotiation and approval from a committee of Paramount’s directors. According to The Wall Street Journal, while the economic terms of the merger had been agreed upon, other critical aspects were still under discussion. Paramount’s board had been advocating for the merger to be subject to a vote by all shareholders, a point of contention for Skydance. The Journal reported that Skydance found the idea of a shareholder vote “a nonstarter.” The committee was expected to vote on the merger on Tuesday, but the outcome of that vote remains uncertain.

Following the collapse of the Skydance deal, it appears Redstone will now explore selling National Amusements independently, without the added complexity of merging Paramount with another entity. NAI has already attracted interest from other potential buyers, including a group led by Hollywood producer Steven Paul and media executive Edgar Bronfman Jr., who has backing from private equity giant Bain Capital. This continued interest underscores the significant value and strategic importance of NAI’s assets.

As of now, both Paramount and Skydance have declined to provide further comments on the matter. The future direction of Paramount and the potential sale of NAI remain closely watched by industry analysts and investors.

SOURCE Wall Street Journal: https://www.wsj.com/business/media/shari-redstones-nai-

decides-to-stop-discussions-with-skydance-1b81985b

NY Post: https://nypost.com/2024/06/11/media/shari-redstone-kills-skydance-bid-for-

paramount-global/