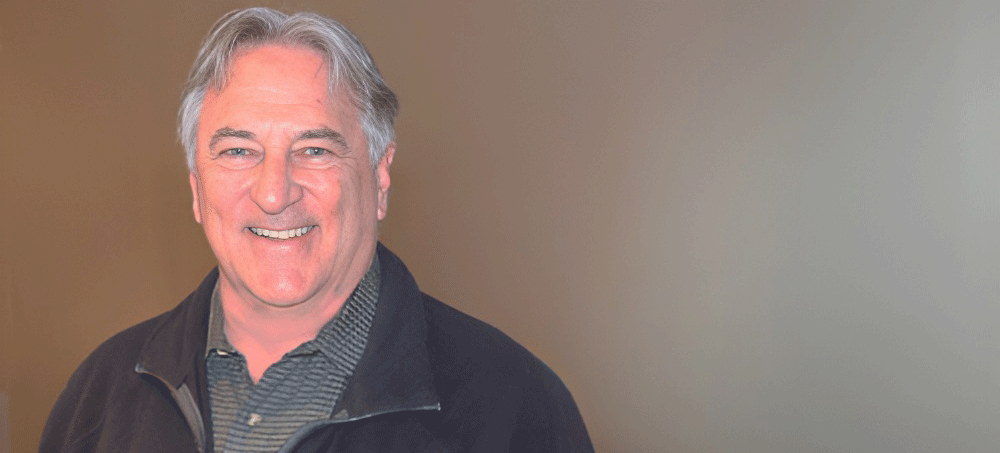

Hollywood Before and After Streamers: A Conversation with Gary Marenzi

Gary Marenzi knows Hollywood like the back of his hand.

Originally from the San Francisco area, where he graduated from Stanford University, he has been living and working in Los Angeles for many decades. Marenzi has held prestigious positions such as President of International Television at Paramount Pictures, President of the Worldwide Television Group at MGM, and head of Entertainment Sales at Endeavor Content. He is also the founder of Marenzi & Associates. Currently, he serves as a Director at the Hollywood Radio & Television Society and works as an independent strategic consultant. He has witnessed the entertainment industry undergo significant changes, being transformed and revolutionized by the emergence of streaming platforms.

“There is a precise moment that pretty much changed everything, I think. It was February of 2013, when House of Cards premiered on Netflix. Starring Kevin Spacey as the Machiavellian and ruthless congressman Francis Underwood, this show was the first major streaming drama, with all 14 episodes released at once in the marketplace. Before that, the world was very different.

How so?

Most scripted shows were ordered by US networks – ABC, NBC, CBS, Fox, and CW – or by basic cable networks, such as TNT, FX, Lifetime, History Channel, A&E Television, and USA Network. These channels had broad appeal, reaching a wide audience. So, I’m not a statistician, but suffice it to say that if you go back just 10 years from now, you’ll see that the free-to-air channels, the basic cable channels, and the premium pay TV channels like HBO and Showtime dominated the ratings with many scripted television shows. Additionally, in those days, we could rely on broadcast syndication, which is the secondary market. Most shows that aired on broadcast television or basic cable would produce anywhere from 13 to 22 episodes a season. If you accumulated enough episodes after four or five years of being on the air, you could then sell them to broadcast syndication channels, which are the local independent stations that would “strip” these shows across Monday through Friday, spreading them among millions of viewers across the country. You really wanted your show to get on a network or on a cable channel and accumulate 66 or more episodes, enough to sell it in the aftermarket to syndication. That was the Holy Grail of profits back then, a real gusher of money.

How are things different today?

Fast forward to today, and you won’t find many new opportunities for new shows in broadcast television. Conversely, in basic cable, there are hardly any new shows being ordered; they’ve virtually halted production on original scripted series. The market is now dominated by streamers like Netflix, Amazon, and Apple, who produce, distribute, and capture a significant portion of viewership. However, instead of producing 22 episodes per season, shows now typically opt for six or eight. Additionally, broadcast syndication has significantly decreased, as people are not watching as much linear television anymore; they are primarily tuning in to streamers. If you go back 10 or 15 years, when I was out there with my clients trying to pitch original shows, and even sell library shows in the US market, I had 20-25 buyers, and I could sell it to broadcast or basic cable or syndication or pay TV. Right now, the market has conglomerated into a few large groups, and one person makes decisions for each company. I just have seven buyers. Seven people to meet and convince.

Do you remember how your job started shifting into something different?

I used to oversee global television distribution at Endeavor Content, which is now called Fifth Season. I joined them in 2016. We produced and sold shows like The Night Manager and Killing Eve. The first two years of my tenure there were great; we had fantastic products, we were building them, and we were selling them internationally. Life was good, I suppose. By 2018, every major show we wanted to produce or invest in was being acquired by one of the global streamers: Netflix, Amazon, or Apple, for the most part. My role was to handle distribution, taking content produced in the US or Britain and selling it around the world, territory by territory. Suddenly, I didn’t have any major content to sell because we were making one deal with a global streamer. I no longer had any rights.

That must have been hard.

At that point, reality hits you hard. You realize, “Oh, the streamers are making significant investments, and they’re getting the cream of the crop in terms of projects. If they succeed, it’s not advantageous for free-to-air broadcasters or basic cable because they can’t make those kinds of investments, mainly because they rely heavily on advertisers.”

The streamers, at that point, were solely focused on growth, so they could afford to lose money on a show. As long as the subscriber base expanded, it was acceptable. The investors didn’t mind. They just wanted the streamers to dominate the market and build a broad audience base. Netflix is renowned for this approach. For many years, they operated at a loss, spending extravagantly to amass subscribers. Only in the past couple of years have they started moving towards profitability by raising prices and introducing advertising.

Initially, when the streamers entered the scene, they outspent traditional broadcasters. Traditional companies couldn’t afford to invest $10 million per one hour episode in a series. The competition was unequal. That’s why the industry consolidated to just a handful of buyers, as we see today.

Do you see this trend happening only in the US or also internationally, let’s say in Italy?

I’m mostly referring to the US, but there’s also a global effect of it. Internationally, I believe there’s a lag of about three or four years. Broadcasters still hold sway, and there’s still some presence of basic cable, and the streamers haven’t completely taken over. This is probably thanks to companies like RAI because they have well-funded public broadcasters. Moreover, in many places, cable penetration has never been high, so people are accustomed to free-to-air television and similar offerings.

In conclusion, Gary, in this landscape that has undergone radical transformation and is still evolving, what do you think are some of the central issues now?

I am wondering if niche and regional services around the world will be run by the six main players.

Share:

Gary Marenzi knows Hollywood like the back of his hand.

Originally from the San Francisco area, where he graduated from Stanford University, he has been living and working in Los Angeles for many decades. Marenzi has held prestigious positions such as President of International Television at Paramount Pictures, President of the Worldwide Television Group at MGM, and head of Entertainment Sales at Endeavor Content. He is also the founder of Marenzi & Associates. Currently, he serves as a Director at the Hollywood Radio & Television Society and works as an independent strategic consultant. He has witnessed the entertainment industry undergo significant changes, being transformed and revolutionized by the emergence of streaming platforms.

“There is a precise moment that pretty much changed everything, I think. It was February of 2013, when House of Cards premiered on Netflix. Starring Kevin Spacey as the Machiavellian and ruthless congressman Francis Underwood, this show was the first major streaming drama, with all 14 episodes released at once in the marketplace. Before that, the world was very different.

How so?

Most scripted shows were ordered by US networks – ABC, NBC, CBS, Fox, and CW – or by basic cable networks, such as TNT, FX, Lifetime, History Channel, A&E Television, and USA Network. These channels had broad appeal, reaching a wide audience. So, I’m not a statistician, but suffice it to say that if you go back just 10 years from now, you’ll see that the free-to-air channels, the basic cable channels, and the premium pay TV channels like HBO and Showtime dominated the ratings with many scripted television shows. Additionally, in those days, we could rely on broadcast syndication, which is the secondary market. Most shows that aired on broadcast television or basic cable would produce anywhere from 13 to 22 episodes a season. If you accumulated enough episodes after four or five years of being on the air, you could then sell them to broadcast syndication channels, which are the local independent stations that would “strip” these shows across Monday through Friday, spreading them among millions of viewers across the country. You really wanted your show to get on a network or on a cable channel and accumulate 66 or more episodes, enough to sell it in the aftermarket to syndication. That was the Holy Grail of profits back then, a real gusher of money.

How are things different today?

Fast forward to today, and you won’t find many new opportunities for new shows in broadcast television. Conversely, in basic cable, there are hardly any new shows being ordered; they’ve virtually halted production on original scripted series. The market is now dominated by streamers like Netflix, Amazon, and Apple, who produce, distribute, and capture a significant portion of viewership. However, instead of producing 22 episodes per season, shows now typically opt for six or eight. Additionally, broadcast syndication has significantly decreased, as people are not watching as much linear television anymore; they are primarily tuning in to streamers. If you go back 10 or 15 years, when I was out there with my clients trying to pitch original shows, and even sell library shows in the US market, I had 20-25 buyers, and I could sell it to broadcast or basic cable or syndication or pay TV. Right now, the market has conglomerated into a few large groups, and one person makes decisions for each company. I just have seven buyers. Seven people to meet and convince.

Do you remember how your job started shifting into something different?

I used to oversee global television distribution at Endeavor Content, which is now called Fifth Season. I joined them in 2016. We produced and sold shows like The Night Manager and Killing Eve. The first two years of my tenure there were great; we had fantastic products, we were building them, and we were selling them internationally. Life was good, I suppose. By 2018, every major show we wanted to produce or invest in was being acquired by one of the global streamers: Netflix, Amazon, or Apple, for the most part. My role was to handle distribution, taking content produced in the US or Britain and selling it around the world, territory by territory. Suddenly, I didn’t have any major content to sell because we were making one deal with a global streamer. I no longer had any rights.

That must have been hard.

At that point, reality hits you hard. You realize, “Oh, the streamers are making significant investments, and they’re getting the cream of the crop in terms of projects. If they succeed, it’s not advantageous for free-to-air broadcasters or basic cable because they can’t make those kinds of investments, mainly because they rely heavily on advertisers.”

The streamers, at that point, were solely focused on growth, so they could afford to lose money on a show. As long as the subscriber base expanded, it was acceptable. The investors didn’t mind. They just wanted the streamers to dominate the market and build a broad audience base. Netflix is renowned for this approach. For many years, they operated at a loss, spending extravagantly to amass subscribers. Only in the past couple of years have they started moving towards profitability by raising prices and introducing advertising.

Initially, when the streamers entered the scene, they outspent traditional broadcasters. Traditional companies couldn’t afford to invest $10 million per one hour episode in a series. The competition was unequal. That’s why the industry consolidated to just a handful of buyers, as we see today.

Do you see this trend happening only in the US or also internationally, let’s say in Italy?

I’m mostly referring to the US, but there’s also a global effect of it. Internationally, I believe there’s a lag of about three or four years. Broadcasters still hold sway, and there’s still some presence of basic cable, and the streamers haven’t completely taken over. This is probably thanks to companies like RAI because they have well-funded public broadcasters. Moreover, in many places, cable penetration has never been high, so people are accustomed to free-to-air television and similar offerings.

In conclusion, Gary, in this landscape that has undergone radical transformation and is still evolving, what do you think are some of the central issues now?

I am wondering if niche and regional services around the world will be run by the six main players.